estate tax changes build back better

5376 commonly known as the Build Back Better Act the. That was Step 1.

:max_bytes(150000):strip_icc()/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 Definition

115-97 increase the limits on certain discounts of value for.

. The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million indexed for inflation. It would also extend the time the cap is effective. It would eliminate the temporary increase in exemptions enacted in the Tax Cuts and Jobs Act TCJA.

The House Ways and Means Committee recently released its plan to pay for President Bidens proposed Build Back Better Act. Prior versions of the Build Back Better Act didnt contain a modification to the 10000 cap but the Nov. Gift and Estate Taxes Proposed Under the Build Back Better Act Lowering the gift and estate tax exemptions seems a lock.

Senate Yet to Act December 3 2021 Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been introduced in the House of Representatives. Trusts and estates lawyers and advisors have been keeping a close watch on recent developments regarding the tax proposals contained in HR. This provision section 137601 would increase from 10k to 80k not indexed for inflation the cap on the federal tax deduction for state and local income and real estate taxes aka the SALT cap.

The provisions effective date is January 1 2022 and the expectation is the law will not seek to apply retroactively to gifts made in 2021. Lowering the gift and estate tax exemptions seems a lock. December 6 2021 The Build Back Better Act was passed by the House of Representatives on November 5 2021 and is headed for the Senate.

This preliminary analysis is still available here. Gift and Estate Taxes Proposed Under the Build Back Better Act Lowering the gift and estate tax exemptions seems a lock. 5376 the Build Back Better Act The modified version of the bill includes a substantial number of changes to the tax-related provisions of the bill as approved by the House Budget Committee in September 2021.

The House-passed Build Back Better Act would increase the limitation amount on the deduction for state and local taxes from 10000 to 80000 40000 for married taxpayers filing separately and. Now Step 2 may not have to. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

3 version introduced an increase to the cap with a slightly higher increase in the Nov. Day Pitney Generations Newsletter. Tax The House of Representatives on Friday morning passed HR.

This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction. For trusts the SALT cap would be 50 of the individual amount or 40k. House Bill Proposes Changes for Estate Planning Under the Build Back Better Act.

Any modification to the federal estate tax rate. As initially proposed the Act would have reduced the current 117 million basic exclusion amount BEA to approximately 6 million on January 1. The House Ways and Means Committee recently released a draft of the tax changes proposed as part of the budget reconciliation bill to implement President Bidens social and.

President Bidens proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan. As the draft now stands the legislative proposal may restrict the abilities of higher net worth individuals to shelter. Tax Changes for Estates and Trusts in the Build Back Better Act BBBA The Build Back Better Act BBBA.

Lowering the gift and estate tax exemptions seems a lock. Read TaxNewsFlash Overview of changes. The bill encompasses a wide range of budget and spending provisions and has been the focus of protracted negotiations for.

Proposed Federal Tax Law Changes Affecting Estate Planning. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Build Back Better Act and Estate Planning Changes.

While the plan is still in negotiations and changes. Step 2 would be to forgive the note immediately before passage of an estate tax exemption balance reduction or whenever the donor was ready to do so. The amended change would raise the cap to 80000 from 2021-2030 and revert back to 10000 for 2031.

However the Senate may put some of those provisions back in before passing. October 29 2021 The House Rules Committee earlier today released a modified version of HR. The revised version of the bill is silent regarding grantor trusts.

The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million indexed for inflation. Heres what you need to know. It remains at 40.

5376 the Build Back Better Act by a vote of 220213. The prior version of the Build Back Better bill made substantial and far-reaching changes to the taxation of grantor trusts and transactions between the grantor and the trust which would have virtually eliminated the use of grantor trusts as an estate planning tool. Estate Taxes One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for.

The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million indexed for inflation. November 5 2021. The provisions effective date is January 1 2022 and the expectation is the law will not seek to apply retroactively to gifts made in 2021.

5376 would revise the estate and gift tax and treatment of trusts. President Bidens Build Back Better Act BBBA has made a significant first step towards passage as the House Ways and Means Committee approves the bills tax provisions. The BBBA proposal seeks to reduce these exemptions from its current 117 million per individual to 5 million indexed for inflation.

None of the major provisions that would have affected estate planning were included in the House version. Many of the changes to the Internal Revenue Code proposed by that plan would directly impact gift and estate tax planning. An elimination in the step-up in basis at death which had been widely discussed as.

SIGNIFICANT ESTATE GIFT AND INCOME TAX CHANGES PROPOSED UNDER THE BUILD BACK BETTER ACT On September 13 2021 the House Ways and Means Committee released a proposed tax bill House proposal as part of the Biden administrations Build Back Better Act.

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Inheritance Tax Here S Who Pays And In Which States Bankrate

Biden Announces 2 Trillion Climate Plan The New York Times

What Types Of Federal Grants Are Made To State And Local Governments And How Do They Work Tax Policy Center

Crawl Outta Debt Now 5 Secret Steps To Get Debt Free Exposed Learning To Be Savers Debt

Biden Announces 2 Trillion Climate Plan The New York Times

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

2020 Was The Right Time To Increase My Real Estate Portfolio By 1 Million Wealth Building Estate Tax Being A Landlord

Lily Batchelder Overview Nyu School Of Law

One Person Who Deserves Blame For Biden S Stalled Agenda Is Joe Biden The Washington Post

Cold Emails Real Estate Investment Trust Life Hacks Beauty Job Hunting

5 Top Benefits Of A Roth Ira Bankrate Roth Ira Old Man Cartoon Roth

Where Not To Die In 2022 The Greediest Death Tax States

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

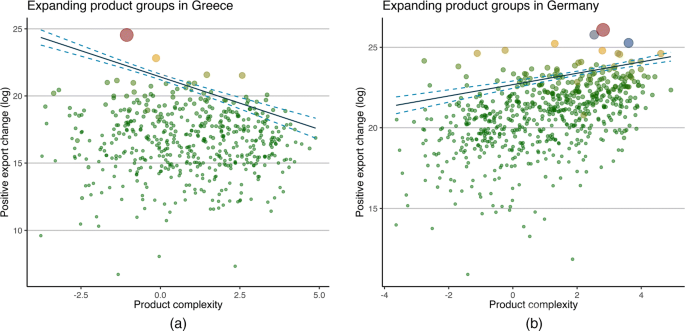

Structural Change In Times Of Increasing Openness Assessing Path Dependency In European Economic Integration Springerlink